Online payday loans may offer a quick, short-term financial solution for emergencies, but they come with high interest rates and fees that can harm your credit. Payday Hex doesn’t offer these loans but helps you understand them and explore potentially more affordable options.

Loan Details

- Amounts: $300 – $5,000

- Repayment Term: 4 – 24 Months

- Minimum Credit Score: No minimum required

The figures provided are representative of a typical installment loan and are not guaranteed rates or terms.

Understanding Payday Loans: A Guide by Payday Hex

What Are Payday Loans?

Payday loans, also called payday advances, are short-term, high-interest loans meant to tide borrowers over until their next paycheck. These loans offer a quick solution for those needing immediate financial assistance, often targeting individuals with less-than-perfect credit scores.

Payday Hex’s Offering

Payday Hex does not offer online payday loans but provides online personal loans even for those with bad credit. The aim here is to help you understand online payday loans and determine if they are suitable for your situation.

Types of Payday Loans

Payday loans are typically for small amounts and are designed to be repaid with the borrower’s next paycheck. These loans are often used for unexpected expenses or emergencies, especially by those with poor credit scores. Many borrowers prefer online cash advances due to their speed and convenience compared to storefront options.

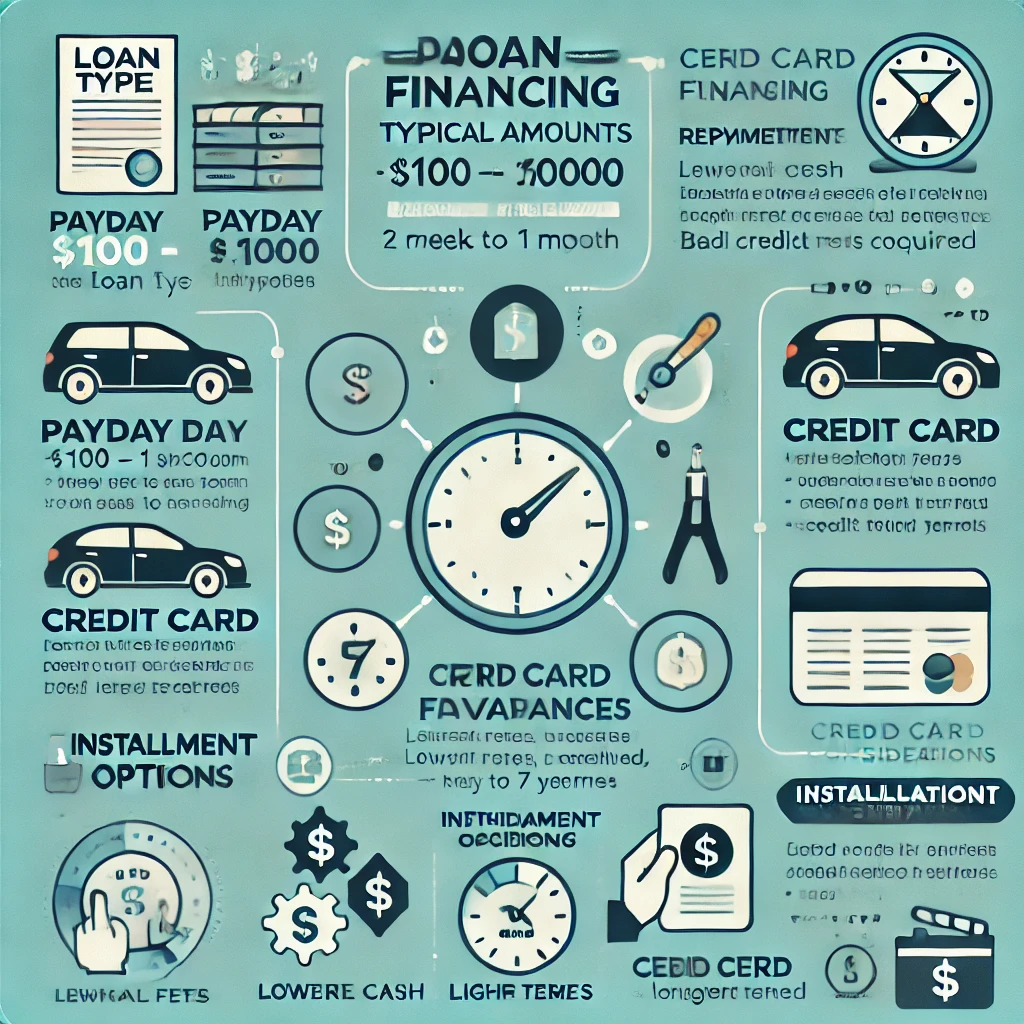

Comparing Loan Types

Understanding how payday loans stack up against other financial products is crucial:

| Loan Type | Typical Amounts | Repayment Duration | Considerations |

|---|---|---|---|

| Payday Financing | $100 – $1,000 | 2 weeks to 1 month | High fees, easy to obtain, bad credit considered |

| Personal Financing | $1,000 – $50,000 | 1 to 7 years | Lower rates, longer terms, credit check required |

| Credit Card Cash Advances | Varies | Until balance paid | Immediate cash, high interest, cash advance fees |

| Installment Options | $1,000 – $50,000 | 2 to 5 years | Fixed payments, lower rates, credit check required |

| Auto Title Financing | 25% – 50% of value | 15 to 30+ days | High rates, risk losing car, no credit check |

| Pawn Shop Financing | Depends on value | Usually 30 days | Risk losing item, no credit check |

*Figures are typical values and may vary based on the lender and borrower’s credit score.

How Payday Loans Work

Applying for an online payday loan involves several key steps:

- Eligibility Requirements:

- Proof of Income: Provide pay stubs or bank statements.

- Valid Identification: Government-issued ID.

- Proof of Residency: Documents like utility bills or lease agreements.

- Active Bank Account: For direct deposit and automatic repayment.

- Application Process:

- Find a Lender: Research reputable payday lenders.

- Pre-approval: Apply online or in-person for a pre-approval estimate.

- Compare Options: Evaluate loan amounts, interest rates, and terms.

- Final Approval: Complete the final approval process, which may involve credit checks.

- Receive Funds: Approved loan amounts are typically deposited within one business day.

Interest Rates and Fees

Payday loan fees include origination fees, late payment fees, and NSF fees. The APR for a two-week payday loan averages around 400% but can be higher for those with poor credit. Borrowers must be fully aware of these costs before proceeding.

Repayment Terms

Loan amounts vary based on income and state regulations, from a few hundred to several thousand dollars. Understanding the repayment terms is crucial before accepting a payday loan.

Who Benefits from Payday Loans?

Payday loans benefit individuals needing quick cash who may not have access to traditional credit forms. This often includes those with poor credit. These loans are popular for their speed in providing funds for emergency expenses.

Regulatory Framework

Payday loans are regulated at both federal and state levels:

- Federal Oversight: The Consumer Financial Protection Bureau (CFPB) ensures transparency and fairness.

- State Regulations: Each state has its regulatory agency overseeing payday lending.

Federal law requires lenders to disclose the finance charge and APR before the borrower agrees to the loan. Borrowers should familiarize themselves with these laws to understand their rights.

Payday Loan Alternatives

There are several alternatives to payday loans, including personal loans, credit card cash advances, credit union loans, and installment loans. These options often provide lower interest rates and more flexible repayment terms.

Payday Loan FAQs

- What are online payday loans?

- Short-term loans available over the internet for quick cash needs.

- How do payday loans differ from personal loans?

- Payday loans are for smaller amounts and shorter terms with higher rates.

- How do I request an online payday loan?

- Fill out an application on the lender’s website with personal and financial details.

- What should I look for in a loan agreement?

- Total loan amount, interest rate, fees, repayment terms, and default consequences.

- Are online loans the same as payday loans?

- Not all online loans are payday loans; they can include personal and installment loans.

- Can I get a payday loan with bad credit?

- Yes, many lenders offer payday loans to those with poor credit but at higher rates.

Our Thoughts on Payday Loans

While payday loans can provide quick financial relief, their high-interest rates and fees make them a risky option. Borrowers should understand the terms, consider alternatives, and have a repayment plan. Financial decisions today can impact long-term financial health.

A Message from Payday Hex

At Payday Hex, we emphasize the importance of informed financial decisions. When considering payday loans, explore all options, including traditional banks, credit unions, and online lenders. Seek professional financial advice if needed. Remember, managing payday loans responsibly is crucial due to their high costs. Your financial choices today shape your future.